What Is a Delaware S Corporation?

The definition of an S corporation is either a general corporation or a close corporation that has elected to be taxed pursuant to Subchapter S of the IRS code.

To create an S-Corp you must first form one of the following:

- General Corporation: The most basic form of corporation, often referred to as a stock corporation or open corporation;

- Close Corporation: A closely-held corporation in which a small group of people are the shareholders, directors and officers, and who wish to remain a small group;

- Public Benefit Corporation: A for-profit entity that commits to supporting a chosen public benefit cause as identified on its Certificate of Incorporation.

Once your corporation is formed, you can then file Form 2553 with the IRS within 75 days of the formation date to elect for S-Corp tax status.

After the IRS approves your application, your corporation will not have to pay U.S. federal income taxes. Instead, the tax liability (or tax credit) will be passed through to the individual shareholders according to their ownership share of the S corporation.

How to elect a C-Corporation to an S-Corporation?

Before you elect your C-corporation to an S-corporation, the company must meet certain eligibility criteria. First, your corporation must have fewer than 100 shareholders. Next, your C-corporation cannot have more than one class of stock. Finally, all shareholders must be U.S. citizens or residents and not other legal entities. If your company meets all these criteria, you can submit form 2553 with the IRS.

As a pass through entity, S-Corps protect their owners from double taxation. One of the disadvantages of general and close corporations is that the profits on these types of corporations can be taxed twice—once at the corporate level by way of a corporate income tax and again at the individual shareholder level if a dividend is declared.

The election of Subchapter S tax status allows the profits of the corporation to pass through the entity to the individual shareholders and, accordingly, is only taxed once. Thus one of the benefits of an S corporation in Delaware is that it has all of the benefits of a Delaware corporation but with a different tax status. Comparing Delaware S-Corps vs C-Corps, S-Corp losses are passed through to the shareholders, who are protected from double taxation. C-Corps have more flexibility in ownership with unrestricted classes of stock and the option to have an unlimited number of shareholders. You can learn more about C Corporations on our website.

Subchapter S tax status is reserved for small business corporations and refers only to a company's federal taxation. In some states, it may be necessary for the corporation to file IRS Form 2553 in order to be treated as an S corporation for state income tax purposes.

If you don't submit Form 2553, your corporation will be a C corporation.

Difference Between an S Corporation and an LLC

Corporations and LLCs are separate legal entities that offer limited liability protection to the owners. If a General or Close Corporation elects for S-corporation tax status the shareholders must be U.S. citizens or residents. Furthermore, S-corporations cannot be owned by other entities like LLCs, partnerships, or other corporations. Corporations and LLC have different ownership structures. LLCs can have Members (owners) serve as managers or have separate members and managers. Corporations have three tiers of power; shareholders (own the company), directors (run the company) and officers (run the day-to-day operations). In a Delaware corporation one person can hold all company positions.

Can an LLC be an S-Corp?

While an LLC cannot become an S-Corp, an LLC can choose to be taxed like an S corporation. After electing S Corporation Tax Status and meeting the necessary S-Corp requirements, an LLC can file Form 2553 to achieve a similar tax outcome to an S-Corp.

Can an S Corporation Own an LLC?

Yes, an S-corp can own an LLC. S-corporations have their own limitations and cannot be owned by other entities, but they can serve as owners for other entities.

Do I need to live in Delaware to form an S-Corporation there?

No, you don't need to reside in Delaware to form a corporation there. Many companies incorporate in Delaware without conducting business in the state. You are, however required to have a registered agent with a physical address in Delaware.

Qualifications for S-Corp Tax Status

- Must file IRS Form 2553 in a timely manner to elect subchapter S status

- Requires the approval of all shareholders

- Cannot have more than 100 shareholders

- Cannot have more than one class of stock

- The entity must be a domestic corporation

- Shareholders cannot be non-resident aliens

- Shareholders cannot be other companies

Benefits of an S-Corp?

- Pass-through tax treatment - A Delaware S-Corp won't pay income taxes on its profits. Typically, this is passed through to the owners and will report the income on their personal taxes.

- Can own shares of a C-Corp - There's no legal barrier preventing an S-Corp from owning a C-Corp.

- Allowed to own 100% of a C-Corp - An S-Corp can own a C-Corp, but the S-Corp will lose pass through taxation for profit from those shares.

- Investors can write off early losses - The S-Corp losses pass through to the shareholders and can be reported on their personal tax returns.

- Avoids double taxation on dividends - As pass-through entities, S-Corps don't pay income taxes on profits. Only shareholders do.

- Can be a member of a single-member LLC or a multi-member LLC - LLCs have flexible membership rules, allowing them to be individuals or other businesses.

Disadvantages of S-Corp Status

- Restricted to 100 shareholders - Unlike C-Corps, which can have unlimited number of shareholders, S-Corps are limited.

- Restricted to one class of stock - A Corp can have any number of classes of Stock. To maintain their tax status, an S-Corp can only have one.

- Cannot own shares in another S-Corp - Ownership limitations for S corporations prevent them from being owned by other S-Corps.

- Losses pass through to the shareholders - While owners can report income on their personal taxes, they will also have to report the losses.

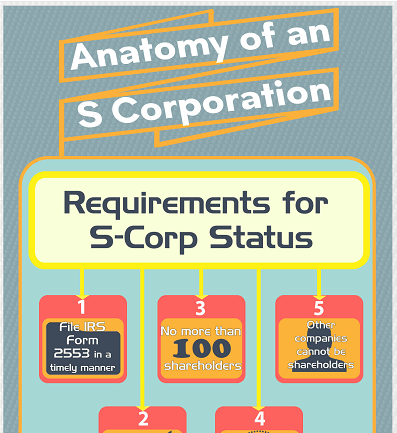

Infographic: Requirements for S-Corporation Status

Here's a quick reference for the requirements of having S-Corp status for your corporation, along with the advantages and disadvantages.

The HBS Blog offers insight on Delaware corporations and LLCs as well as information about entrepreneurship, startups and general business topics.

Since 1981, Harvard Business Services, Inc. has helped form over 400,000 Delaware corporations and LLCs for people all over the world.

Harvard Business Services, Inc. guarantees your annual Delaware Registered Agent Fee will remain fixed at $50 per company, per year, for the life of your company.

Harvard can provide assistance throughout the life of your company. These custom services are the most popular with our clients: