What is a DBA, or Doing Business As? Understanding Assumed Business Names

What is a DBA?

A DBA, which means "doing business as," is simply a fictitious name registration, also referred to as an assumed business name. It’s a way for a company to operate under a name other than its registered name. However, electing a DBA does not provide the same legal protections as having a separate business entity, such as a Corporation or LLC.

Every day, people inquire about setting up a DBA for their Delaware LLC or Delaware corporation. Business owners often choose to operate under multiple, different names for a number of different ventures. For example, ABC Company, Inc. may find the need to set up multiple, different DBAs using the names XYZ Landscaping, Inc. and 123 Construction, Inc.

While both XYZ Landscaping, Inc. and 123 Construction, Inc. are both assumed business names that are still legally recognized as ABC Company, Inc., the fictitious names can better convey the services and products the company offers its potential customers.

Do I need a DBA?

There are a few scenarios where it may be beneficial to apply for a DBA. However, in my experience, the current trend has business owners leaning toward incorporating a Delaware LLC or corporation with the actual name under which they plan to operate. Since the company name is often linked to a website, trademark, patent, logo or some other type of branding, setting up the DBA is kind of unnecessary.

Still, some situations do make a lot of sense for filing a DBA. Some examples of such situations would be:

- A business begins to offer a product or service that does not fit under the registered company name. For instance, a bicycle repair shop that begins selling car tires may want a separate name for that piece of the business.

- A company formed in Delaware only needs to have a name that is unique to Delaware. However, if the company applies for Foreign Qualification in another state, such as California, the name must also be unique in California. If the original name of the company is already being used by another business in California, the company can create a DBA to operate in that state.

- Franchise owners often use DBAs. Because they only own their independent franchise business(es) and are not owners at the corporate level, they typically form their own company under a different name, then use the franchise name as the DBA. For example, a Wendy’s owner in Miami might form “Miami Restaurant Holdings, Inc” as the company owning the franchise, then file a DBA to operate as Wendy’s of Miami.

For these situations and many others, it is not uncommon for people to set up a DBA as a fictitious name for a corporation or LLC formed in Delaware. The question then becomes, where do I setup the DBA?

Where can I set up a DBA?

Traditionally, in Delaware, the DBA registration is completed in the county in which the company predominantly operates and does business. Next you might be wondering if you need to file for your LLC or corporation DBA in Delaware. Again, it depends where your company physically operates and transacts business. If the company is actually located and conducting business in the state of Delaware, then a Delaware DBA filing will typically be necessary.

You can fill out the necessary forms online to set up your DBA in Delaware. Depending on where in Delaware the company is headquartered, the DBA registration can be filed with the New Castle, Kent or Sussex County Prothonotary's Office. Usually, DBA registration will require the following information:

- Name and address of the corporation or LLC

- Date of formation

- The DBA or fictitious name

- Nature of business

- Names and addresses of members/directors/officers

- Contact phone number

- Name of authorized person signing the title and notarization

If your company does not operate in Delaware—if it operates in any other state—the same rules, in general, apply for DBAs. The application for aDBA is still handled at the county level. If your Delaware LLC or corporation is operating in another jurisdiction, you may need to register for Foreign Qualification before filing for the DBA.

We’re happy to answer any questions you have about setting up a DBA for your Delaware LLC or corporation. Give us a call today at 1-800-345-2677. We’re ready to help you.

Multiple DBAs

We are sometimes asked how many DBAs a single LLC or corporation can have. The answer is that there is typically no limit that states or counties impose. Your company can have one, two, or ten DBAs if it wishes.

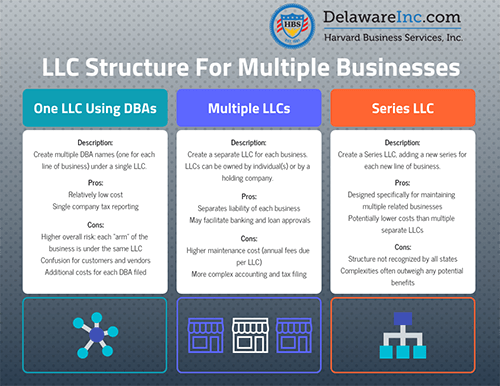

However, you should always consider if multiple DBAs are the most strategic way to proceed. While they do allow your business to operate under multiple names, hosting multiple DBAs at the same time can also present some issues, such as:

- Higher overall risk by having each “arm” of the business under the same company

- Complicated tax filing

- Confusion for customers and vendors

- Additional costs for each DBA filed

DBA vs. Multiple LLCs

As a final point, our clients sometimes are conflicted between utilizing a DBA and just setting up a separate LLC in addition to the one they already operate. There is no blanket rule about which is correct or incorrect; rather, each situation involves its own unique circumstances, as well as the preferences of the business owner.

As a final point, our clients sometimes are conflicted between utilizing a DBA and just setting up a separate LLC in addition to the one they already operate. There is no blanket rule about which is correct or incorrect; rather, each situation involves its own unique circumstances, as well as the preferences of the business owner.

It is important to keep in mind that using multiple LLCs does provide a greater level of protection and lower overall risk due to having each LLC be a separate legal entity. Issues that arise in one LLC typically do not put the other LLC's assets at risk. This is not true of DBAs, where the registered LLC and each other DBA are all considered to be the same legal entity.

Next: Operating Multiple Businesses Under One LLC

*Disclaimer*: Harvard Business Services, Inc. is neither a law firm nor an accounting firm and, even in cases where the author is an attorney, or a tax professional, nothing in this article constitutes legal or tax advice. This article provides general commentary on, and analysis of, the subject addressed. We strongly advise that you consult an attorney or tax professional to receive legal or tax guidance tailored to your specific circumstances. Any action taken or not taken based on this article is at your own risk. If an article cites or provides a link to third-party sources or websites, Harvard Business Services, Inc. is not responsible for and makes no representations regarding such source’s content or accuracy. Opinions expressed in this article do not necessarily reflect those of Harvard Business Services, Inc.

There are 8 comments left for What is a DBA, or Doing Business As? Understanding Assumed Business Names

leo said: Friday, September 6, 2019How long I'll have to wait to recive a DBA statusor what it is?

HBS Staff replied: Friday, September 6, 2019Generally, DBAs are filed in the county of the state in which you're operating. The turnaround time can vary among states and different counties. We recommend contacting your local county office (often the Prothonotary office) to inquire about your expected waiting time.

Sultan White said: Friday, August 23, 2019Hi, we are a customer for Harvard Business Services. We are incorporated as Civil Impact Fund but would like to do business simply as Civil Impact. We originally wanted to incorporate simply as Civil Impact but we were required to tag on a "Inc", "LLC", or "Fund". Is a DBA required to use a shortened version of the name? Thank you.

HBS Staff replied: Tuesday, August 27, 2019DBAs are generally handled by the county and state in which you are physically operating. We recommend checking with your state's policy regarding DBA names or consult your attorney for assistance.

Mary said: Wednesday, January 30, 2019Hi, We are your current customer, Astralia LLC. Would you be able to help us setting up a DBA? What are the steps involved? Thank you, Mary

HBS Staff replied: Thursday, January 31, 2019Mary, we’re happy to answer any questions you have about setting up a DBA for your Delaware LLC or corporation. Give us a call today at 1-800-345-2677 or use the live chat feature here on our website.

1 | 2